Smart Choices, Bright Futures: Why and Just how You Must Save for College

Smart Choices, Bright Futures: Why and Just how You Must Save for College

Blog Article

Building a Solid Financial Structure for University: Top Methods for Smart Planning

As the expense of college remains to rise, it has actually become significantly vital for trainees and their households to develop a solid economic foundation for their college. With correct preparation and tactical decision-making, the desire for going to university can come to be a fact without sinking in the red. In this conversation, we will certainly discover the top approaches for wise economic planning for college, consisting of establishing clear goals, understanding university expenses, producing a budget plan and cost savings plan, discovering scholarships and gives, and considering student lending options. By applying these techniques, you can lead the way for a economically secure and effective college experience. So, allow's dive right into the world of clever monetary preparation for college and uncover exactly how you can make your desires happen.

Setting Clear Financial Goals

Establishing clear economic goals is an important action in reliable financial planning for college. As trainees prepare to get started on their college journey, it is vital that they have a clear understanding of their financial objectives and the steps called for to achieve them.

The very first element of establishing clear monetary goals is specifying the price of university. This involves investigating the tuition charges, holiday accommodation expenditures, books, and various other assorted prices. By having a thorough understanding of the monetary requirements, trainees can establish sensible and achievable objectives.

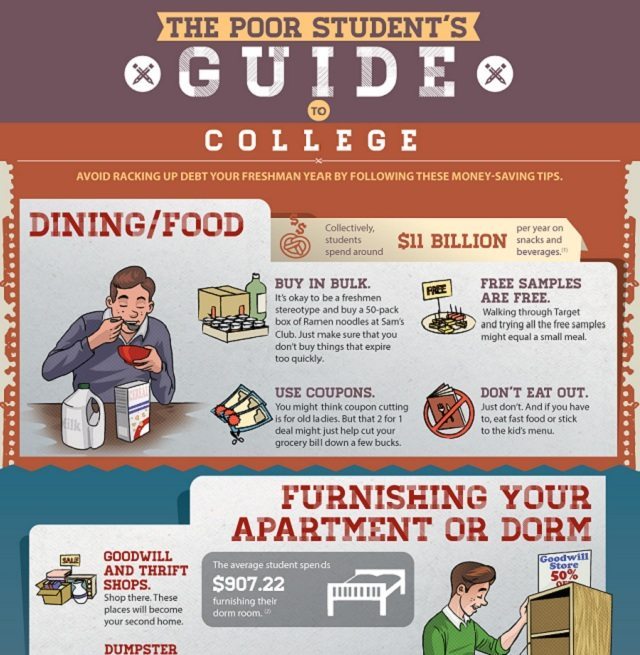

As soon as the price of university has actually been figured out, pupils need to develop a spending plan. This includes analyzing their revenue, consisting of scholarships, gives, part-time tasks, and parental payments, and after that allocating funds for essential costs such as real estate, tuition, and food. Creating a spending plan helps pupils prioritize their investing and makes sure that they are not spending too much or collecting unneeded financial obligation.

Additionally, establishing clear economic objectives likewise includes identifying the demand for financial savings. Students ought to determine just how much they need to conserve each month to cover future expenses or emergencies. By setting a cost savings objective, trainees can establish healthy and balanced economic behaviors and get ready for unpredicted conditions.

Comprehending University Prices

College prices can vary substantially depending on factors such as tuition fees, housing expenditures, books, and other various charges. Understanding these expenses is vital for effective financial planning. Tuition charges are one of the most significant expenditure for most university student. They can differ widely depending upon the kind of establishment, program of research, and whether the trainee is an out-of-state or in-state resident. Housing expenditures likewise play a significant duty in college costs. Trainees can choose to live off-campus or on-campus, and the price can vary depending upon the place and amenities supplied. Books are another cost that trainees need to consider. The cost of textbooks can be rather high, however there are alternatives like renting or acquiring previously owned books to conserve cash. In addition, there are various other assorted charges to think about, such as meal plans, transportation, and individual expenses. It is essential for trainees and their households to thoroughly study and recognize these expenses to develop a realistic budget and financial prepare for college. By comprehending the numerous parts of university expenses, visit our website individuals can make educated choices and prevent unnecessary financial stress.

Producing a Budget and Financial Savings Strategy

Producing a detailed spending plan and savings strategy is crucial for reliable economic preparation throughout college. Begin by detailing all your sources of income, such as part-time jobs, scholarships, or financial aid. It requires regular monitoring and modification to ensure your financial security throughout your university years.

Exploring Scholarships and Grants

To optimize your economic sources for college, it is essential to explore available scholarships and grants. Save for College. Scholarships and grants are a fantastic means to fund your education without needing to depend heavily on lendings or personal financial savings. These financial help are normally awarded based on a variety of variables, such as academic accomplishment, sports performance, extracurricular participation, or discover here monetary need

Beginning by looking into scholarships and gives supplied by schools you want. Lots of institutions have their very own scholarship programs, which can supply considerable economic support. Additionally, there are many outside scholarships available from foundations, organizations, and organizations. Web sites and on-line data sources can aid you find scholarships that match your rate of interests and qualifications.

When obtaining scholarships and grants, it is vital to pay attention to deadlines and application requirements. The majority of scholarships call for a finished application, an essay, letters of referral, and records. Save for College. Make certain to comply with all instructions carefully and send your application in advance of the due date to enhance your possibilities of receiving funding

Checking Out Trainee Car Loan Options

When considering just how to finance your university education, it is necessary to check out the various check these guys out alternatives offered for student fundings. Student loans are a hassle-free and common means for students to cover the prices of their education and learning. Nonetheless, it is important to recognize the different kinds of student loans and their terms before making a choice.

An additional option is private student lendings, which are offered by banks, credit scores unions, and other private lenders. These finances typically have higher rates of interest and a lot more rigid payment terms than federal car loans. If government financings do not cover the complete cost of tuition and other expenses., exclusive fundings may be necessary.

Conclusion

Finally, developing a strong monetary structure for university needs establishing clear objectives, recognizing the prices entailed, developing a spending plan and savings plan, and exploring scholarship and grant possibilities. It is crucial to consider all available options, including student loans, while minimizing personal pronouns in a scholastic creating design. By complying with these techniques for clever planning, pupils can navigate the monetary elements of college and lead the means for a successful scholastic trip.

As the cost of college proceeds to climb, it has ended up being significantly important for trainees and their families to construct a strong monetary structure for their greater education. In this conversation, we will certainly check out the leading methods for smart economic preparation for college, consisting of setting clear goals, recognizing college prices, producing a budget plan and savings strategy, exploring grants and scholarships, and thinking about student loan alternatives. It is essential for pupils and their households to thoroughly study and comprehend these prices to produce a practical spending plan and financial strategy for university. These monetary help are normally awarded based on a selection of variables, such as scholastic achievement, sports efficiency, extracurricular participation, or financial need.

By complying with these strategies for wise planning, pupils can navigate the economic facets of college and pave the way for an effective academic journey.

Report this page